Here’s why hundreds of thousands of https://1investing.in/ers spread across more than 70 countries Trust Equitymaster. You basically need to study the direction of the underlying stock and you’re sorted. ETFs can either be purchased on the exchange or directly from the Fund. The Fund creates / redeems units only in predefined lot sizes in exchange for a predefined underlying portfolio basket (called “creation unit”). Once the underlying portfolio basket is deposited with the Fund together with a cash component, the investor is allotted the units.

There are so many moving parts in the Nifty that is 50 counters and in the Bank Nifty 10 counters that you will basically have to take a view on where the top three four five weighted stocks are headed. For example, Reliance with a weightage of 12 to 14% and the weighted changes every month. If the stock is going down in price, the weightage goes down if the stock is rising, the weightage goes up. This data is available from the website every month on the first of the month itself.

Trading Account

Stock Indices are helpful to understand a market’s overall direction and as a barometer of the underlying economy. Basically, there’s more variety in global indices than on the Cheesecake Factory menu. Use them to understand where the markets are headed and inform your trading strategy. This page will show you ideas, news, and price action for various market indices.

The fortunes of these futures would depend on the performance of the overall sector. National Commodity & Derivatives Exchange Limited is a nation-level, technology -driven online commodity Exchange with an independent Board of Directors and professional management. It is committed to provide a world-class commodity Exchange platform for market participants to trade in a wide spectrum of commodity derivatives driven by best global practices, professionalism and transparency. Stream live futures and options market data from NCDEX and capitalize on the opportunities as they unfold. In the comments section, do let me know what you think of this video and what you would want me to record in mine next. Also help me reach out to fellow like-minded traders who believe in a knowledge based investments and trading system by referring my video to family and friends.

Investors are requested to note that Stock broker is permitted to receive/pay money from/to investor through designated bank accounts only named as client bank accounts. Stock broker is also required to disclose these client bank accounts to Stock Exchange. Hence, you are requested to use following client bank accounts only for the purpose of dealings in your trading account with us. The details of these client bank accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker”.

Group Companies

Index trading vs share trading Trading in indices gives you exposure to the companies that are included in the index. For example, if you are trading in the S&P BSE index, you may invest in any of the 30 companies entered in the index. Method of index construction To be able to trade in an index smartly, you should be able to understand how an index is constructed. For a company to be included in an index, it should meet certain criteria and should consistently maintain the said criteria, or it would be replaced by another stock with a better potential. For example, a Stock Option on Reliance Shares will move in tandem with the price movement of the shares of Reliance Industries during the trading hours in the Indian Stock Markets. As is the case with individual equities, a trader can ‘sell’ an index at a higher price than the price at which he/she bought the stock or ‘buy’ an index back at a lower price than the one he/she originally ‘sold’ it for.

Because they have lower expense ratio, there are fewer recurring costs to diminish ETF returns. That’s not all, an investor has to understand a lot when it comes to investing. We all know Sensex has top 30 companies, but it does not mean that these 30 are best for your investment.

What are Index Futures?

All eyes will now be on the March quarter earnings, which begin this week with major IT companies coming out with numbers. During the truncated week, the Nifty 50 gained 1.4 percent, while the broader market outperformed with the smallcap index rising 2.3 percent. FII long positions on index futures, which at the start of the April F&O series were at a paltry 9 percent, have now risen to 18 percent. The Market Intermediaries Regulation and Supervision Department is responsible for the registration, supervision, compliance monitoring and inspections of all market intermediaries in respect of all segments of the markets viz. Equity, equity derivatives, currency derivatives, debt and debt related derivatives.

- But even after a gap of more than 8 years, the revised series of indices could not be compiled and released by DGCI&S.

- Among the index options, an index call option is a right to buy the index and an index put option is a right to sell the index.

- Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters.

National list of countries by current account balance & Derivatives Exchange Limited is a nation-level, technology driven on-line recognised stock exchange with an independent Board of Directors and professional management. It is committed to provide a commodity Exchange platform for market participants to trade in a wide spectrum of commodity derivatives. This is quite different from an actively managed fund, like most mutual funds, where the fund manager ‘actively’ manages the fund and continually trades assets in an effort to outperform the market. Index Options are the derivative instrument, which means their value is derived from the movements in the underlying index. In India, there are popular indexes like the Sensex, Nifty, Bank Nifty, Nifty Financial Services. Supposed you want to take a view on these indices rather than on individual stocks, you can use index options.

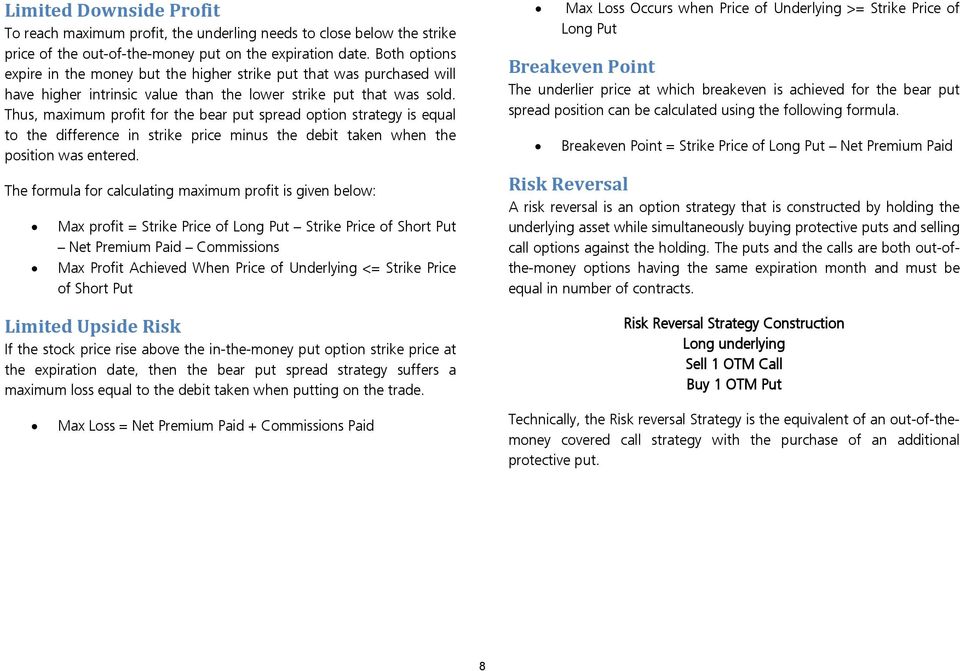

Summarizing Index Options

In this method, the index value is measured based on the market capitalization rather than measuring on the stock price of the company. An investor must keep in mind that the market capitalization of a stock keeps on changing every day with the change in its price, and because of this reason, the weightage of the stock keeps changing daily. Options are a right to buy or sell an underlying asset without the obligation to buy or sell that underlying asset. The underlying cannot just be an asset like equities or commodities, but also notional assets like indices and currencies. The buyer of the option has the right without the obligation for which he pays the premium. The seller of the option has the obligation without the right for which he receives the premium.

- Few indices choose companies based on their market capitalization.

- This weightage defines a company’s ability to regulate the index by that percentage.

- Both parties agree to close their holdings lawfully at a specific price and on a specific date.

Traders need not pay the full notional value of the contract to buy the options lot. The premium/ option price is determined using options calculatorand is usually nominal compared to actual Index contract value. However, if volatility is seen in the entire market, prices of even Index Options can fluctuate heavily. In such a scenario, smart traders look for Stock Options which are holding their ground and showing a lower volatility than the Index Options.

Trade Setup for April 10: Earnings season to take centre stage as Nifty 50 enters another truncated week

Instead, indices can be traded via index funds, index futures, options, ETFs (exchange-traded funds), or CFDs . CFDs are an attractive option for traders as they are leveraged products, which means that profits can be booked on both the rise and fall in the index prices. Experienced traders can use futures contracts to bet on the future direction of an underlying asset or index. Simply put, it means that instead of buying or selling futures contracts, investors can wager on a group of assets by speculating on a bullish or bearish market. Traders must stay current with market developments in order to lock in successful positions when speculating. Finance Minister Nirmala Sitharaman tabled the Union budget 2019 a few days back.

The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities. Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters. You can check about our products and services by visiting our website You can also write to us at , to know more about products and services. ETFs combine the range of a diversified portfolio with the simplicity of trading a single stock. Investors can purchase ETF shares on margin, short sell shares, or hold for the long term.

Day trading guide for 11th April: M&M, TechM, BPCL to Zomato — 6 stocks to buy or sell on Tuesday Mint – Mint

Day trading guide for 11th April: M&M, TechM, BPCL to Zomato — 6 stocks to buy or sell on Tuesday Mint.

Posted: Tue, 11 Apr 2023 00:41:34 GMT [source]

This index is inclusive of 50 stocks instead of the 30 that make up the Sensex. Which one of which one of these two trading elements suits you? Your pocket size, your attitude and aptitude, your risk appetite and just how much stress you can take in the marketplace before you keel over and say this much and no further. So on the day that Reliance goes down and HDFC Bank and HDFC Limited go up, the Nifty remains constant. There are so many moving parts to trading the index that you basically need a mathematical model to trade an index. I am recording this video on 27th of October evening and you would have seen how the markets have defied gravity.

Historically, investors have relied heavily on derivatives to achieve temporary exposure. The large denomination of most derivative contracts can preclude investors, both institutional and individual, from using them to gain market exposure. In this case and in those where derivative use may be restricted, ETFs are a practical alternative. Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. Index Options is a derivative instrument wherein the underlying asset is corresponding Index viz. Nifty 50 Index, NSE Bank Nifty Index or NSE Nifty Midcap 50 or NSE NIFTY IT Index and so on and so forth.