Operating income from the previous section is then added to non-operating items. The final figure shows the net income (or net loss) of the business for the reporting period. In this section, you are finding your operating income after essential expenses. This gives you how much operating income your business can generate while managing fixed operating costs. Your total operating expenses are subtracted from gross profit, from the previous section, to show operating income.

- Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

- On the other hand, some investors may find single-step income statements to be too thin on information.

- The third section is the non-operating head, which lists all business incomes and expenses that are not related to the principal activities of the business.

- For a company that sells goods (merchandise, products) the first subtotal is the amount of gross profit.

The major headings on a multi-step income statement are revenue, gross profit, operating income, non-operating income, and net income. Together, these sections provide a detailed overview of a company’s financial performance. This is the amount of money the company made from selling its products after all operating expenses have been paid. If a company’s operations are strong, it will almost always show a profit at the bottom line, but not all companies with a profitable bottom line have strong operations. It might have lost money from its operations but had a huge insurance settlement that pushed a profit to the bottom line. Before you prepare your income statement, you need to select a reporting period.

Single-Step vs Multi-Step Income Statement

Manufacturers, for example, use multi-step income statements to clearly separate production and overhead costs. Multi-step statements are more detailed and segmented according to types of income and expenses, which show how a business progresses toward net income, or in some cases a net loss. The gross margin portion includes the cost of products sold from operational expenditures. This is critical because it allows investors, creditors, and management to assess the sales and purchase the financial statement’s efficiency.

This would include large manufacturing businesses as well as large, complex retailers. Publicly traded companies should also create multi-step income statements, because they’re required by law to disclose more detailed financial reports to show their earnings. On the other hand, a multi-step income statement follows a three-step process to calculate the net income, and it segregates operating incomes and expenses from the non-operating incomes. It separates revenues and expenses from activities that are directly related to the business operations from activities that are not directly tied to the operations.

Multi-Step Income Statement: Is It Right for Your Business?

Complicating procedures with just a few revenue streams isn’t conducive in accounting. Generally, eCommerce and large mid-level companies prefer the multi-step income statement because it translates the complexity of their high sales volume into a readable P&L. Companies that are publicly traded, in compliance with GAAP, have strict reporting rules for income statements. They are required to have multi-step income statements for each period, to show whether expenses are ordinary and necessary to the business. This is so governing agencies can have a clear window into what they are doing financially, in the name of public trust. Large businesses are the most likely to prepare a multiple step income statement.

A single-step income statement accounts for a business’s net income straightforwardly. Still, a multi-step income statement accounts for net income in three steps, separating operational from non-operational revenues and costs. First, you need to calculate net sales (the sum of a company’s sales minus returns, discounts, and allowances). Many operating expenses will be grouped into one line to simplify calculations. Creating a multi-step income statement is a labor-intensive process for a company. Accounting teams need to be robust to correctly account for the line items and classifications of revenues and expenses.

Calculate Gross Profit

Right after computing the total operating income, the other revenues and expenses section is the revenue and expense incurred from non-operating activities. Generally, businesses that use multi-step income statements are large, complex companies. Most small businesses and sole proprietorships can get by with just a single-step income statement, since their operations and accounting tend to be straightforward. The selling and administration expenses from operating activities are captured in the second section of a multi-step income statement. The selling expenses are the costs incurred when selling goods to consumers and may include marketing expenses, the salary of sales personnel, and freight charges. Users can gain insights into how a company’s primary business activities generate revenue and affect costs compared to the performance of the non-primary business activities.

A Beginner’s Guide to the Multi-Step Income Statement – The Motley Fool

A Beginner’s Guide to the Multi-Step Income Statement.

Posted: Wed, 18 May 2022 16:56:39 GMT [source]

This combines expenses of operating the business, such as production and administration, and non-operating expenses, such as interest paid on debt. To artificially boost their margins, management could move spending out of the cost of products sold and into operations. It’s usually a good idea to look at comparative financial accounts over time to see trends and detect misplaced spending. Then, in the operational activities column, add the entire operating expenditures. This would include the costs of selling, advertising, wages, and administrative costs like office supplies and rent. An insurance payout paid to the company’s account as settlement proceeds for damage or loss of a company’s asset can also be considered non-operating income.

How confident are you in your long term financial plan?

The Multi-Step Income Statement allows for more in-depth analysis compared to a Single-Step Income Statement. It is very popular because it not only shows gross profit but also product vs labor contribution margins and even net income. For instance, if your business is charged with 10% of tax expense from a total of $60,000 of net income, thus, your business will have to bear $6,000 of tax expense.

This section not only helps measure the profitability of the core business activities, it also helps measure the health of the business. On the other hand, some investors may find single-step income statements to be too thin on information. The absence of gross margin and operating margin data can make it difficult to determine the source of most expenses and can make it harder to project whether a company will sustain profitability. Without this data, Multi step income statement investors may be less likely to invest in a company, causing businesses to miss out on opportunities to acquire operating capital. An income statement is an essential financial document a company prepares to describe its business activities over a given reporting period. This financial summary of a company’s revenue, expenses, and earnings are typically presented as part of a package that also includes a company’s balance sheet and cash flow statement.

Multi-Step Income Statement

The Multi-Step Income Statement is more comprehensive and easier to understand. It can be used to compare more of the company’s products and services at once. A Multi-Step by Sales Contribution is a Multi-Step Income Statement that groups transactions into categories based on the percent contribution to total sales for each category.

Most publicly-traded companies use multiple-step income statements, which categorize expenses as either direct costs (also known as non-operational costs), or indirect costs (also known as operational costs). Direct costs refer to expenses for a specific item, such as a product, service, or project. Contrarily, indirect costs are generalized expenses that go towards a company’s broader infrastructure, and therefore cannot be assigned to the cost of a specific object. Examples of indirect costs include salaries, marketing efforts, research and development, accounting expenses, legal fees, utilities, phone service, and rent.

AYR Wellness Reports Second Quarter 2023 Results – Ayr Wellness Inc.

AYR Wellness Reports Second Quarter 2023 Results.

Posted: Thu, 17 Aug 2023 11:03:50 GMT [source]

A multi-step income statement also differs from an income statement in the way that it calculates net income. A single-step income statement includes just one calculation to arrive at net income. Multi-step income statements, on the other hand, use multiple equations to calculate net income. In doing so, they also calculate gross profit and operating income, which aren’t included on a single-step income statement. In comparison, a single-step income statement gives a simple record of financial activity.

The multi-step income statement provides detailed reporting of your company’s revenues and expenses using multiple steps to arrive at net income. Multi-step income statement items include revenue, cost of goods sold, and expenses, which are calculated to arrive at net income. The statement shows the line items gross profit and operating income, which are metrics commonly looked at by management, investors, and creditors. This statement gives you an accurate measurement of company performance, and may also be called a profit and loss statement.

Throughout this article, readers will encounter not only a thorough examination of each segment but will also be guided through illustrative examples that bring the Multi-Step Income Statement to life. This robust exploration will elucidate how this pivotal financial statement acts as a beacon for informed decision-making in the dynamic world of business finance. The Revenue account shows the revenue generated by normal business activities that includes any deductions and discounts given to customers. Here is one example of a multi-step income statement format for XYZ Company for the year 2020.

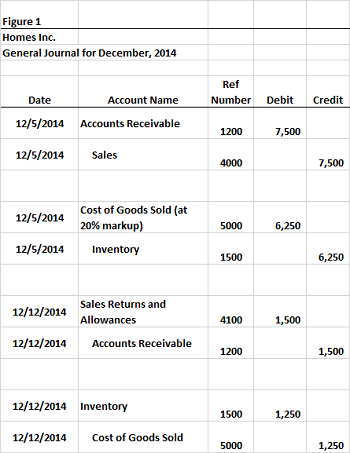

- In the above example, we follow the periodic format to compute the Cost of Goods Sold.

- It focuses on net income, so it is especially helpful if you need to make an assessment that is based on your business’s bottom line.

- The layout of the multi-step will allow the user to see the performance of the operating and non-operating components.

- Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

Small business owners with simple operations, such as sole proprietorships and partnerships, may prefer the single-step income statement. As they grow in size and complexity, businesses graduate to the multi-step income statement, which sorts revenue and expenses into categories and shows how a business determines net income before taxes. The publicly traded company most commonly utilizes multi-step income statements. The primary distinction of this kind of presentation is categorizing costs into direct (non-operational costs) or indirect (operational costs). A corporation’s sales, costs, and total profit or loss are all reported on a multi-step income statement for a specific reporting period.