Content

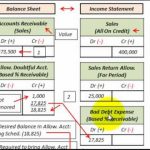

Upon the realisation of its benefits, the related expense will then need to be acknowledged on the firm’s profit and loss statement. The visual below shows that if we were to prepay 6 months of rent at $100 per month, that would result in a debit to prepaid rent of $600 and a credit to cash . A common concern of business owners who do accounting by themselves is whether the prepaid rent is an asset or liability.

Therefore, your operational income will be smaller the higher your rent expenditures. Rent costs directly affect the quantity of money in your company’s vault. Manufacturing enterprises may handle their rent costs significantly differently. These businesses incorporate rent costs as part of production overhead considerably more frequently. Other SG&A costs include a variety of outlays, including wages, office supplies, insurance, and legal fees.

Prepaid Insurance

The account should be reviewed before closing the books at the end of each month. Therefore, when recording prepaid rent, it is very important to not forget to shift the prepaid rent into an expense account in the exact month that the rent is consumed. If not, the financial statements would under-report the expense and over-report the asset. That is why it is advisable for the bookkeeper to keep track of the contents of the prepaid rent account and review it before closing the books at the end of each month.

For instance, the useful life of a piece of equipment was predicted to be 5 years. If the lessee chooses to exercise the purchase option, the proceeds represent an extra gain. Additionally, by doing it in this manner, the lessor’s annual income can be sufficiently decreased to move into a reduced tax rate, resulting in additional money saved.

How Do Prepaid Expenses and Accrued Expenses Vary?

Ignite staff efficiency and advance your business to more profitable growth. Automatically process and analyze critical information such as sales and payment performance data, customer payment trends, and DSO to better manage risk and difference between prepaid rent and rent expense develop strategies to improve operational performance. Transform your order-to-cash cycle and speed up your cash application process by instantly matching and accurately applying customer payments to customer invoices in your ERP.

What is a prepaid rent expense account?

A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date.