Content

The Capital to Risk (Weighted) Assets Ratio is another name for it (CRAR). In other words, it is a bank’s capital ratio to its current obligations and risk-weighted liabilities. Banks should always maintain a minimum Capital to Risk-Weighted Total Asset ratio (CRAR) of 9%. The Capital Adequacy Ratio established guidelines for banks by assessing each institution’s capacity to meet its obligations and respond to operational and credit risks.

It is therefore less likely to go bankrupt and lose the money of its depositors. Risk-weighted assets are used to measure the amount of capital that must be held by a bank based on the ratio of assets weighted by risk. This is to help banks avoid inability to pay liability or settle credit exposures. Risk-weighted assets help to determine the capital requirement needed to cater for the risk of each asset.

What you need to know about capital adequacy ratio

The COVID-19 pandemic has hit the banking system at its core owing to large public debts and the inability of investors to pay off debts due to insufficient demand. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. A higher than minimum CAR is always preferred as it gives more safety to the depositors, and is a reflection of strong internal controls and risk framework. The CAR also makes it easier to compare banks of different countries as the ratio is standardized. One will see that two different capitalizations are measured in the above CRAR formula. Therefore, the capital adequacy of the Bank of America stood at 15.1% for the year 2018 under the advanced approach.

However, as a bank depositor, the capital adequacy ratio protects your money by creating a buffer that aims to prevent the bank from collapsing. With the Basel III agreement, and an added conservation buffer of 2.5%, it is 10.5%. The U.S.’s Federal Deposit Insurance Company (FDIC) calls for an 8% minimum ratio for total capital to total risk-weighted assets. BCBS set the minimum requirement of the leverage ratio at 3% over a full credit cycle. The leverage ratio also referred to at times as the Supplementary Leverage Ratio (SLR), is a ratio derived by the Basel III accords during the aftermath of the great financial crisis.

Currently, the minimum ratio of capital to risk-weighted assets is 8% under Basel II and 10.5% (which includes a 2.5% conservation buffer) under Basel III. High capital adequacy ratios are those that are higher than the minimum requirements under Basel II and Basel III. The capital adequacy ratio (CAR) is an indicator of how well a bank can meet its obligations.

What is the Capital Adequacy Ratio Formula?

So, the capital adequacy ratio is a risk measure for commercial banks that helps the regulatory bodies to keep a close track of the risk level of bank lending. They are a trio of regulatory agreements formed by the Basel Committee on Bank Supervision. The Committee weighs in on regulations that concern a bank’s capital risk, market risk, and operational risk. The purpose of the agreements is to ensure that banks (and other financial institutions) always have enough capital to deal with unexpected losses. Risk-weighted assets are used to determine the minimum amount of capital that must be held by banks and other institutions to reduce the risk of insolvency.

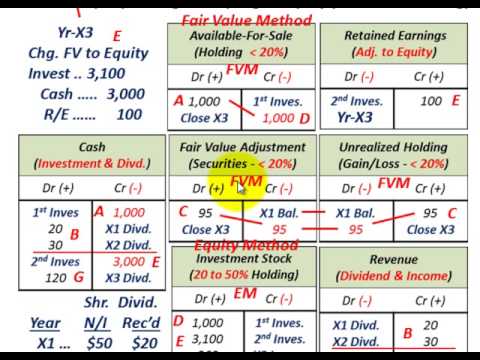

Basel III phases in requirements for Core Tier 1 (common equity), Tier 1 and Total (Tier 1 plus Tier 2). Basically, the ratio of 8.0% in Basel II maps to the Total Capital (Tier 1 + Tier 2) ratio in Basel III, which I will illustrate below. HQLA are essential cash or highly liquid assets that can be converted into cash without any significant value loss.

Build your skills with a risk-free demo account.

The capital adequacy of the banks has been improved in the financial year 2021 for better planning on capital resources and the generation of internal resources of the finance sector. This property of planning ensures the risk management process that has been reflected in the reduction of the credit weighted assets and the growth of advance gross ratio. The capital adequacy position of the SBI banking sector has been improved from 13.06% to 13.74% in the month of March of 2021. This has created an increase in capital of 11.44 percent and Tier-2 capital 2.06 percent. The Indian banking sector has estimated the normal CAR with 9% and risk-weighted asset with 8%.

- The Capital Adequacy Ratio or CRAR measures a bank’s capital compared to its current obligations and risk-weighted assets.

- This content was originally created by member WallStreetOasis.com and has evolved with the help of our mentors.

- The more stable a bank, the safer your business’s investments and assets are.

- CET1 is the highest quality of regulatory capital as it absorbs losses immediately.

- The CAR also makes it easier to compare banks of different countries as the ratio is standardized.

Other assets backed by little or no collateral, such as a debenture, have a higher risk weighting. This is because there is a higher likelihood the bank may not be able to collect the loan. For example, if a bank has lent money to three different capital adequacy ratio formula companies, the loans can have different risk weighting based on the ability of each company to pay back its loan. The Bank of International Settlements separates capital into Tier 1 and Tier 2 based on the function and quality of the capital.

What the Capital Adequacy Ratio (CAR) Measures, With Formula

CAR is important to ensure that a bank has an adequate financial cushion to absorb losses before it declares insolvency. The Capital Adequacy Ratio set standards for banks by looking at a bank’s ability to pay liabilities, and respond to credit risks and operational risks. A bank that has a good CAR has enough capital to absorb potential losses. Thus, it has less risk of becoming insolvent and losing depositors’ money. After the financial crisis in 2008, the Bank of International Settlements (BIS) began setting stricter CAR requirements to protect depositors.

CAR sets standards for the organization to pay for its liabilities, and the firm’s ability to the credit and operational risks. To guarantee that banks have sufficient protection against loss before they become bankrupt and lose depositor money, minimum capital ratios (CARs) are crucial. Tier I capital of a bank denotes the share capital and disclosed reserves. It is a bank’s highest quality capital because it is fully available to cover losses. On the other hand, Tier II capital consists of certain types of subordinated debt and reserves. Assets that do not show any chances of payment by the borrower to the concerned bank are non-performing.

Examples of tier-1 capital include equity capital, intangible assets, ordinary share capital, and audited revenue reserves. This form of capital allows a bank attend to all liabilities without ceasing operations, it is also called the core capital. The tier-1 leverage ratio compares a bank’s core capital with its total assets. It is calculated by dividing Tier-1 capital by a bank’s average total consolidated assets and certain off-balance sheet exposures. The higher the tier-1 leverage ratio is, the more likely a bank can withstand negative shocks to its balance sheet. However, the capital adequacy ratio is applied specifically to banks and measures their abilities to overcome financial losses related to loans they’ve made.

Tier 1 capital is the primary way to measure a bank’s financial health. It includes shareholder’s equity and retained earnings, which are disclosed on financial statements. Off-balance sheet agreements, such as foreign exchange contracts and guarantees, also have credit risks. Such exposures are converted to their credit equivalent figures and then weighted in a similar fashion to that of on-balance sheet credit exposures. The off-balance sheet and on-balance sheet credit exposures are then added together to obtain the total risk-weighted credit exposures.

Capital Adequacy Ratio

The bank is also running with their preserved capacity in the fulfillment of depositors’ demand. Therefore, a high capacity of CAR brings an ability to withstand the financial downturn or the unforeseen losses of the banks. Tracey just landed her dream job as senior vice president of ABC National Bank.

Public sector banks also maintain a minimum amount of CAR for the accommodation of the credit reserve process. Making the regulatory capital more high-quality, predominantly in the form of equity shares ad retained earnings that can absorb losses was the primary focus of Basel III. Risk-weighted assets are utilized for determining the amount of minimum capital that must hold on to by the banks and financial institutions to minimize the risk of insolvency. The tier 1 capital noted in the numerator includes ordinary share capital, audited revenue reserves, future tax benefits, and intangible assets. Tier 1 capital can be used to absorb losses without a bank having to stop its operations.

As of 2022, banks are mandated by Basel-III to have a minimum Capital Adequacy Ratio of 8%. Although the cash reserve buffer is included, the minimum Capital Adequacy Ratio is 10.5%. The Reserve Bank of India (RBI) in India has mandated that the CAR for banking institutions be 9% and that the CAR for public sector lenders is sustained at 12 per cent. As of 2022, RBI has stated that banks with deposits of more than Rs. 100 crore must maintain a minimum CAR of 12% from a previously maintained 9%. However, RBI plans to adopt a four-tiered regulatory framework that would check the financial soundness of Indian banks.